What is customer lifetime value (CLV)?

As the term suggests, CLV is the value a customer holds in the business during their association. Therefore, it is the monetary contribution to the annual profits of the company that a customer has had.

CLV plays a huge role in subscription-based businesses that can better predict and analyze past trends to understand consumer behavior.

How to measure customer lifetime value

Any business can follow four simple steps to measure customer lifetime value.

- Calculate Average Order Value: Businesses need to know their average order value. Businesses will need at least 3 or 5 months to track and value this properly.

- Calculate Average No. of Transactions: The frequency at which customers come into the business is fundamental to note. It gives them an idea of the longevity of their product or service and helps them predict future recurring income.

- Measure Customer Retention: You need to know how long an average customer stays connected with the business. It’s either this or the average churn rate in the company.

- Customer Lifetime Value Calculator Formula: Multiply all the above three figures to get your CLV data. In case you are working with a churn rate, multiply the first two figures and divide by the churn rate. The Customer Lifetime Value Formula clearly shows that businesses can boost any of the three figures to increase CLV.

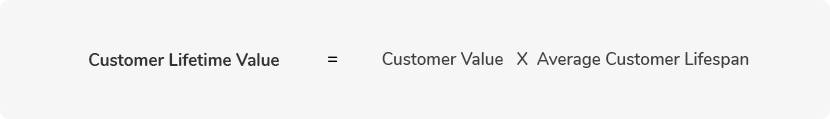

CLV formula

The customer lifetime value (CLTV) is found by taking the average order value and multiplying it by the typical order frequency. Next, you’ll need to estimate the average customer lifespan before you can multiply that number by the value of a single customer to get the total lifetime value of your customers.

CLV calculation analysis example

To understand a SaaS company’s CLV, we must look into an example to see the bigger picture.

Suppose that Firm A in question has a MRR (Monthly Recurring Revenue) of $1 million and has 50 paid subscribers. This means, their average order value would be $1 million divided by 50.

The data we have till now:

MRR: $1 Million

Accounts: 50

Average Order Value: $20,000

Average customer lifespan: 5 years

Therefore, by applying the formula that we discussed in the previous section, the CLV of each of these customers would be $20,000 x 5 = $1,00,000.

Back to churn metrics

Back to churn metrics