What is net revenue retention?

The proportion of recurring income from current customers that was kept during a specified time period, encompassing revenue from growth, downgrades, and cancellations, is known as the Net Revenue Retention (NRR) Rate or Net Dollar Retention (NDR). This attrition statistic provides a thorough overview of both good and bad developments in terms of client retention.

NRR is a crucial statistic for executives of SaaS enterprises and subscription businesses that want to evaluate the consistency of the revenue development of their organizations. Retaining current clients and expanding their contracts are the keys to sustainable development in the SaaS industry.

High turnover rates or account shrinkage may indicate problems with the business’ pricing model, user experience, or product value offering. However, if Monthly Recurring Revenue (MRR) growth is the only metric for success, large acquisition rates might hide these difficulties. Increased net revenue retention indicates scalable and predictable development.

A Net Revenue Retention Rate of more than 100% in the SaaS industry indicates success. The average Net Retention Rate for SaaS firms is 100%. However, the net Retention Rates are greater for products with higher Annual Contract Value (ACV). A respectable Net Retention Rate for SaaS providers targeting small and medium-sized enterprises (SMBs) is 90%, and a decent Net Retention

Rate for Corporate SaaS is 125%.

How to measure net revenue retention

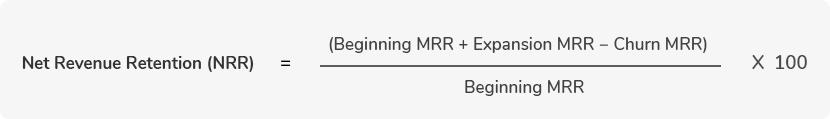

The two main elements affecting a business’s recurring revenue are expansion and churning revenue. NRR is calculated by dividing the sum of the starting MRR, expansion MRR, and churning MRR by the beginning MRR. So, to calculate Net Revenue Retention, you must know the following:

Beginning MRR: The client base’s regular income business has the month before.

Expansion MRR: This month’s revenue from current clients with upgrades and upsells.

Churn MRR: Recurring income lost due to client attrition and downgrades.

Remember that the expanding revenue includes upgrades, upselling, tier-based price increases, and cross-selling. Churn revenue includes the amount from churn, non-renewals, cancellations, or downgrades.

The value then needs to be multiplied by 100 since, for comparability’s sake, NRR is normally represented as a percentage.

The NRR formula may be conceptualized as the division of the MRR from the same customer group in the preceding period by the current MRR from existing customers.

Net revenue retention formula

Here’s the formula to calculate the Net Revenue Retention of a business:

Let’s understand the calculations with an example.

SaaS net revenue retention example

Consider a scenario in which we compare the net revenue retention of two SaaS businesses that are direct rivals in the same industry. The financial information for the two businesses, Company XYZ and Company ABC, is as follows:

Company XYZ had a starting MRR of $1 million in January. The new MRR generated in the month is $600,000. XYZ also recorded an expansion MRR of $50,000 with a loss from Churn MRR of -$250,000.

Company ABC had the same starting MRR of $1 million in January. They did not record any new MRR but had an expansion MRR of $450,000 with a loss from churn MRR of – $50,000.

The initial MRR combined with the new and expansion MRR, less the churn MRR, equals the ending MRR. After using the algorithm, we get the same ending MRR for both businesses of $1.4 million. However, this doesn’t mean their net revenue retention rate will be the same.

Net Revenue Retention (NRR) = (Beginning MRR + Expansion MRR − Churn MRR) / Beginning MRR x 100

Therefore, using the formula, NRR for XYZ = $(1 million + 50,000 – 250,000) / $1 million x 100 = 80% NRR for ABC = $(1 million + 450,000 – 50,000) / $1 million x 100 = 140%

The two businesses’ significant differences in NRR (80% vs. 140%) result from the magnitude of their continued consumer bases.

In the example of Company XYZ, the new MRR masks the churn MRR, meaning the losses are made up for by adding new clients. The assumption that the firm is in an excellent position based only on MRR might be a mistake since the continuing dependence on acquiring new customers to maintain MRR is not a sustainable business strategy.

However, Company ABC did not add any new MRR throughout the month. Although the two rivals’ ending MRRs are the same. Company ABC’s NRR is much larger due to its higher expansion MRR and lower churn MRR, indicating more satisfied customers and a higher possibility of ongoing long-term recurring revenue.

Net Revenue Retention vs Gross Revenue Retention

As explained above, Net Revenue Retention (NRR) helps to understand how your revenue will look over a period if you don’t add new customers. A NRR of 100% or higher shows that your customers are happy and are getting value from your product. NRR also provides an insight into how your revenue will grow from existing customers over time.

Gross Revenue Retention (GRR) shows the Recurring Revenue from your existing customers minus cancellations and downgrades. It does not include business expansion revenue from existing customers. The primary goal of GRR is to understand how customer churn is affecting your revenue. GRR will always be less than or equal to NRR (as expansion revenue is not included).

Both NRR and GRR should be monitored as part of your customer success strategy. Where NRR shows you how much growth and revenue you can expect from your existing customers, GRR would show the revenue you would have made if the customers didn’t churn.

Your goal should be to try and increase your NRR above 100% and your GRR as close to 100% as possible.

Back to churn metrics

Back to churn metrics