What is churn rate?

In a given time period, such as a month or a year, the churn rate is the percentage of customers or subscribers who cancel or do not renew.

A company’s churn rate is crucial for companies with recurring customers, such as SaaS and subscription businesses. You’re in trouble if your average customer acquisition cost (CAC) can’t be recouped regardless of your monthly revenue.

How to measure churn rate?

The calculation of your Churn Rate may seem simple in theory, but it is actually quite difficult. Churn Rate can be calculated as follows:-

Number of customers who left/ Total number of remaining customers*100

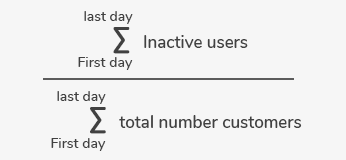

It can be difficult to determine the number of customers you have over a given period – both existing customers and new ones sign up each month. Because of this, there is no one-size-fits-all method for calculating churn. A Churn Rate calculation can be done in four ways:

- The number of customers you have on the first day of the period is divided by the number of churns you have:- Churn/Day 1 customers*100

- Churn is divided by average number of customers during the period:- Churn/(day 1 customers + last day customers) /2*100

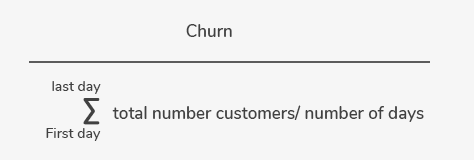

- The amount of churn you should expect each day during a given period:-

- Divide churn by the average number of customers you had during each day of the period (the Shopify method):-

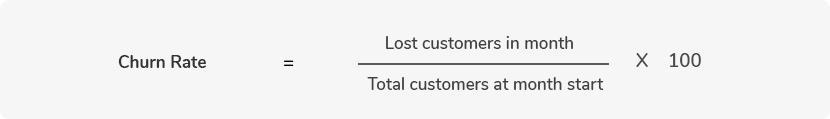

Churn rate formula

(Lost Customers / Total Customers at the Start of Time Period) x 100 is the formula for calculating the churn rate. Suppose your company had 150 customers at the start of the month and lost 5 by the end of the month. 0.03 is the answer. As a result, you get a monthly churn rate of 3% when you multiply 0.03 by 100.

Example of calculating SaaS churn rates

For example, if a SaaS company had 1000 new customers in a given time period and 50 of them left without renewing their subscription.

Customer Churn = 50 ÷ 1000 = 0.05

= 0.05 x 100 = 5 or 5%

Difference between Customer Churn rate and Revenue Churn rate

Customer churn and revenue churn are not always the same and have to be tracked separately. Customer Churn helps you with managing your customers better, assigning Customer Success Managers (CSMs) etc whereas revenue churn helps to understand the financial health of your customer base.

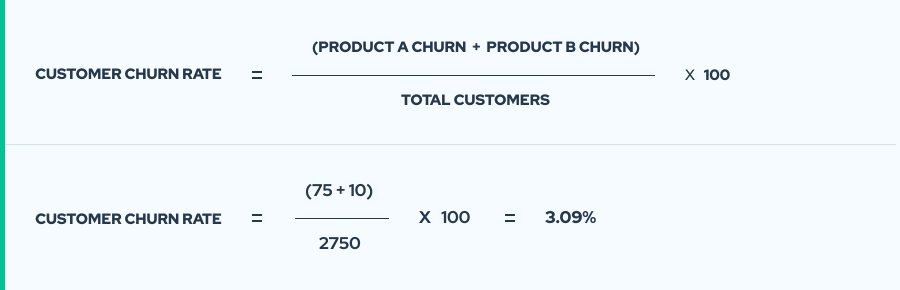

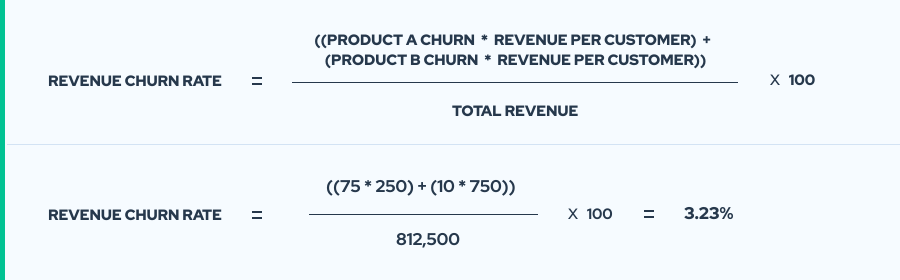

Here is an example, let’s say a company Acme has 2 product lines:

- 1. Sprout:2500 customers paying $250/month per customer

- 2. Blossom:250 customers paying $750/month per customer

This shows that the company has 2750 customers but paying different amounts based on their product lines. The total MRR for the 2750 customers is 812,500 USD. Let’s say 75 sprout customers and 10 blossom customers leave, here is how the customer churn rate and revenue churn rate will differ:

Customer Churn Calculation:

Revenue Churn Calculation:

As you could see there is a difference between Customer Churn Rate and Revenue Churn Rate and this gap will keep getting wider based on the product lines or pricing. Hence both should be taken into account while tracking churn rates.

This is assuming that customers don’t churn during the period and the payments are taken upfront of the whole period.

What is a good Churn rate?

Recurly, the subscription platform ran a survey with their customers to understand the average churn rate by industry and their SaaS customers said their average churn was 4.7%. For established big SaaS companies, the average churn rate is between 4.5 – 7%. Based on the performance of several established SaaS companies, this would be a good number to aim for.

For early-stage SaaS companies, the number could be all over the place and it’s difficult to identify a good number. Until the product-market fit is obtained, the churn is going to be high. But, once that is achieved, the number should stabilize around 4.5% to 5% and that’s the number that you should aim for.

Pricing also has a big impact on churn rate. Companies with a higher ARPU (average revenue per user) see lower churn compared to companies who have a lower ARPU.

Whatever said and done, if you are not sure about churn rate, the best way is to keep improving. Whatever were the previous rates, you improve on it week-on-week and month-on-month.

Churn rate is high, what can I do about it?

Reducing churn can be achieved by means of customer success. Here are some things you can start doing to reduce your churn rate:

-

1. Segment Customers and understand them

Not all customers are the same. Each customer buys your product for different reasons and gets different value out of your product. Segment customers based on few parameters like:

- Revenue (Most valuable customers)

- Industry

- Company size

- Churn risk customers (non-usage, low licence utilisation, nonresponsive customers)

Once you segment your customers initially, understand your high value customers in detail – what makes them stick, what features do they use, how they got their users engaged on your product and understand the value that they get from your product in detail. Once you have done that, work out a strategy on how you can explain the same value to other customers.

-

2. Focus on onboarding

Once you have understood your customers and know what they did right, ensure that new customers are properly onboarded to start off well. Understand why they bought your product and what value they want from your product. Bucket them along with customers who get similar value and nurture them the same way until they get the value from your product.

-

3. Get constant feedback

Whenever a customer tries a new feature or does something important on your product, get customer feedback. Probably they might have not liked somethings in that feature. Use the feedback to improve the product and communicate with that customer until the feature is fixed. Customers love the personal touch and they want to know that your company is listening to them and value their relationship. If you make the product better by listening to their feedback, they will feel great and would want to stick around. More importantly, they would also become an advocate for your business.

-

4. Convert customers to Annual billing

The churn rate reduces tremendously when a customer is on an annual contract for obvious reasons. Not all customers would commit to this initially until they get value from your product but keep working towards it. If a customer is on a monthly billing and you are getting good feedback from them, reach out to them and offer them to upgrade to an annual contract at a special price. Encourage them to convert to an annual contract.

Back to churn metrics

Back to churn metrics