Customer Acquisition Cost (CAC) is the average amount of money it takes to acquire a new customer. It is an important metric for businesses to track because it can help them to understand the profitability of their CAC Benchmarks strategies.

But while in the chaos of making profit. Are you forgetting to calculate the customer acquisition cost?

Neglection can result in high CAC. It turns out that a company is spending too much money to acquire new customers, which can lead to losses.There are a number of factors that can affect CAC, including the industry, the product or service being sold, and the target market.

In this blog, we’ll give you a quick and comprehensive rundown of how to calculate Customer Acquisition Cost (CAC) and which industry benchmarks to compare it against.

What does CAC stand for?

Every customer comes at a price, and CAC is all about figuring out just how much money we have to splash on acquiring a customer. Customer Acquisition Cost (CAC) is the average amount of money a business spends to acquire a new customer. It is an important metric for businesses to track because it can help them to understand the profitability of their acquisition strategies. A high CAC can indicate that a company is spending too much money to acquire new customers, which can lead to losses.

Customer Acquisition Cost (CAC) is the money a business spends to get new customers. You want CAC to be lower than the Lifetime Value (LTV) of those customers – that means more profits!

When things are going great, CAC stays low, and LTV keeps customers happy and spending. But if CAC misbehaves, don’t worry – we’ve got the solutions!

Be smart, strategize, and conquer CAC with our top-notch advice. Keep an eye on the CAC-LTV see-saw and ride the wave of customer love to success!

How to calculate Customer Acquisition Cost

Let’s dive into the nitty-gritty of calculating Customer Acquisition Cost (CAC) step-by-step.

Step 1: Choose a Time Period Let’s say we want to calculate CAC for the last quarter (three months).

Step 2: Calculate CAC During the last quarter, our total marketing and sales expenses amounted to $15,000. This includes various costs like online ads, social media campaigns, and the salaries of the marketing team.

In the same three-month period, we acquired 100 new customers.

Step 3: CAC Formula Now, we plug the numbers into the formula:

| CAC = Total Marketing and Sales Expenses / Number of New Customers CAC = $15,000 / 100 CAC = $150 |

Step 4: Analyse and Act In this example, the CAC is $150.

Now, let’s compare this with the Lifetime Value (LTV) of our customers. Let’s assume the average LTV of a customer is $500 (the revenue generated from a customer over their entire relationship with our business).

Since the CAC ($150) is significantly lower than the LTV ($500), we are in good shape! It means we are spending less to acquire each customer than what they eventually bring in as revenue. Profitable business moves, right there!

However, if our CAC were higher than the LTV, say $600, we would need to rethink our strategies. It might be time to optimise our marketing efforts, improve customer retention, or find cost-effective ways to acquire customers.

With this example, you can see how calculating CAC gives us valuable insights into the efficiency of our customer acquisition efforts. So, gather those numbers, crunch them like a pro, and let CAC be your guiding light towards business success!

Importance of Understanding Customer Acquisition Cost

Imagine you have a shop, and you want more customers to come and buy your cool stuff. But to get customers, you need to spend money on advertising and promotions, right? Understanding CAC is like knowing how much money it costs you to bring in each new customer. It’s like keeping track of how much you spend on advertising for every person who walks into your shop.

Why is this important?

Well, knowing your CAC helps you make smart decisions about where to spend your money. If your CAC is too high, it means you’re spending a lot on advertising, and it might not be worth it if customers don’t spend much in your shop.

On the other hand, if your CAC is low, it means you’re getting a good return on your investment, and customers are bringing in more money than you spend on ads. That’s the sweet spot!

So, by understanding CAC, you can figure out the best ways to attract customers while keeping your costs in check. It’s like having a secret weapon that helps you grow your business wisely and make sure you’re getting the most bang for your buck. Happy business sailing!

Case Study of Customer Acquisition Cost

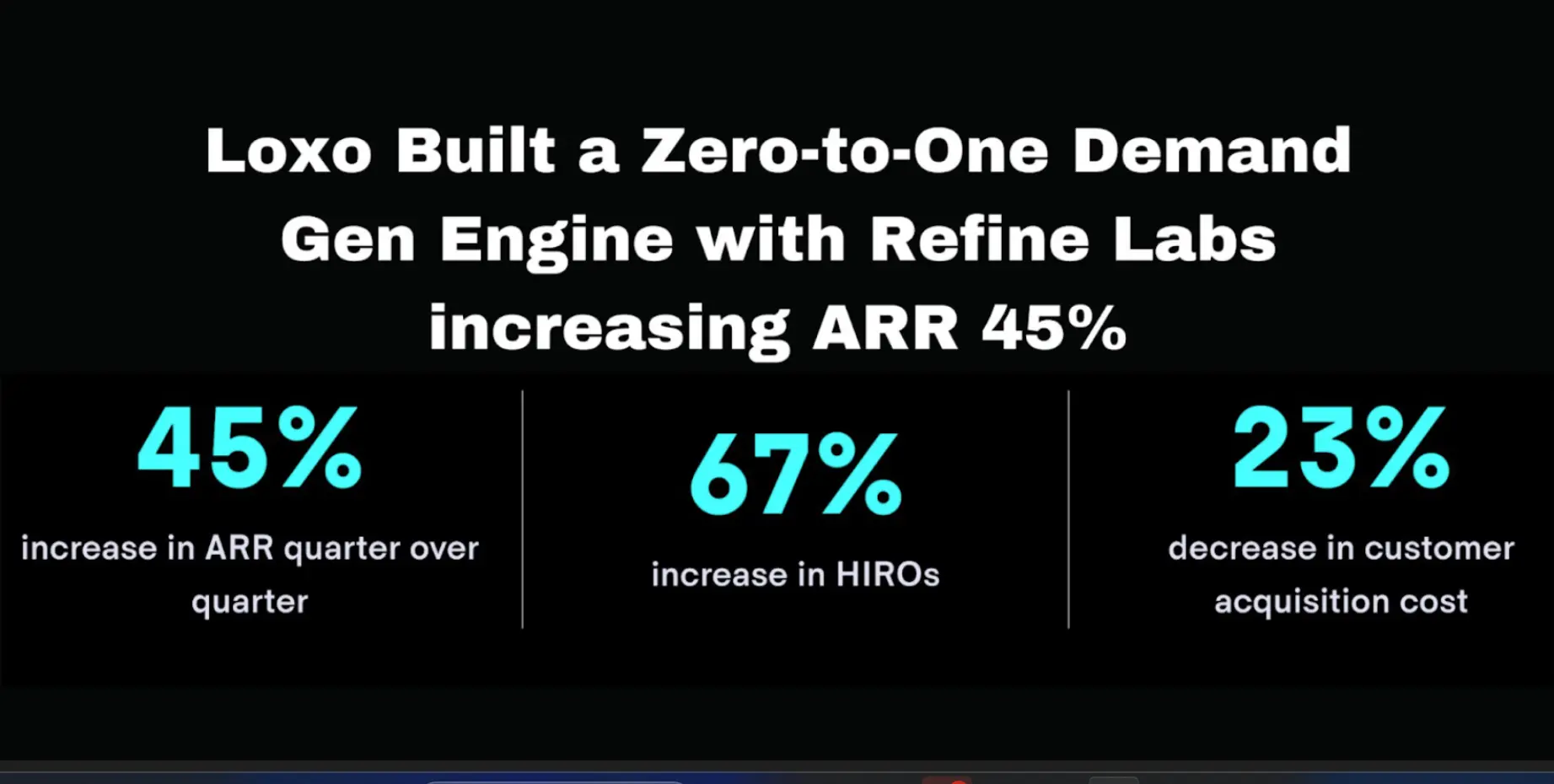

Loxo is a B2B company that uses a dual-motion product-led / sales-led model to acquire customers. However, they were struggling to drive enterprise pipeline and revenue with this model. They were spending a lot of money on performance marketing to get as many free trial sign ups as possible, but this was not resulting in high conversion rates or closed deals.

Loxo shifted from lead gen to demand creation. This meant that they focused on creating demand for their product within enterprise accounts, rather than just getting as many free trial sign ups as possible.

Loxo to create a demand motion from scratch, which included:

- Developing a clear understanding of Loxo’s target audience and their needs.

- Creating content and marketing campaigns that were relevant to Loxo’s target audience.

- Measuring the results of the demand motion and making adjustments as needed.

As a result of this work, Loxo saw a significant improvement in their ARR, HIRO pipeline, and CAC. Their ARR increased by 45% quarter over quarter, their HIRO pipeline increased by 67%, and their CAC decreased by 23%.

This case study shows that it is possible for B2B companies to achieve significant growth with a dual-motion product-led / sales-led model. However, it is important to shift from lead gen to demand creation in order to be successful.

Here are some key takeaways from the case study:

- The winning strategy for B2B companies is to create demand for their product within enterprise accounts. This means focusing on creating content and marketing campaigns that are relevant to the target audience and their needs.

- Shifting from lead gen to demand creation can lead to significant improvements in ARR, HIRO pipeline, and CAC. This is because it helps to ensure that you are only spending money on marketing and sales activities that are likely to result in closed deals.

- It is important to have a clear understanding of your target audience and their needs in order to create effective demand generation content and marketing campaigns. This means understanding their pain points, their goals, and the challenges they are facing.

- You need to measure the results of your demand motion and make adjustments as needed. This will help you to ensure that you are getting the most out of your marketing and sales budget.

Factors to Consider When Calculating Customer Acquisition Cost

Variable Costs

When diving into the world of CAC calculations, you need to consider both variable and fixed costs. Variable costs are like chameleons – they change based on how much you sell or acquire customers.

For example, if you run an online store, variable costs might include the cost of goods sold 5(COGS), shipping fees, and maybe even affiliate commissions. These costs fluctuate depending on how much you sell or how many customers you bring in.

Fixed Costs

On the other hand, fixed costs are more like your trusty sidekick – they remain constant, no matter how much you sell or acquire customers.

Think of rent for your physical store, salaries for your employees, or website hosting fees. These expenses stick around regardless of how many customers come through the door or buy your products.

Cost Per Channel

Now, let’s talk about channels. No, not TV channels – we’re talking about marketing channels, like social media, Google Ads, or email campaigns.

Each channel has its own costs and effectiveness in bringing in customers. When calculating CAC, you’ll want to know how much you’re spending on each channel and how many customers you’re getting from each one.

By understanding the variable and fixed costs and analysing the performance of different marketing channels, you’ll have a clear picture of your CAC. This insight will guide you in making savvy decisions to optimise your marketing efforts and grow your business like a pro!

Estimating Customer Acquisition Cost Benchmarks

Industry Averages

When it comes to estimating Customer Acquisition Cost (CAC), it’s helpful to know how your numbers stack up against others in your industry. Industry averages act like signposts, showing you where you stand in the grand scheme of things.

Check out what similar businesses are spending to acquire customers. If your CAC is higher, it might be time to fine-tune your strategies. On the flip side, if your CAC is lower, kudos to you – you’re ahead of the game!

Goals & Objectives

Understanding your business goals and objectives is essential in estimating CAC benchmarks. Are you looking to maximise short-term profits or invest in long-term customer relationships?

For instance, if you’re aiming for rapid growth, you might accept a higher CAC initially. But if customer loyalty and retention are your top priorities, a lower CAC might be the way to go.

Assessing the Competition

Keeping an eye on your competitors is crucial in this journey. Analyse their CAC numbers and strategies to learn from their successes and mistakes.

If they’re doing better with a lower CAC, it’s time to hoist the sails and follow suit. But if they’re struggling with a higher CAC, you can steer clear of their missteps and set your own course to success!

By estimating CAC benchmarks based on industry averages, aligning with your goals, and scouting the competition, you’ll have a reliable map to guide you on your customer acquisition voyage. Now set sail and conquer the high seas of business with confidence!

Strategies for Reducing Customer Acquisition Cost

Let’s dive deep into these savvy strategies for reducing Customer Acquisition Cost (CAC) while keeping it conversational and informational.

Optimise the Sales Funnel Model

Picture the sales funnel as a fascinating journey that your potential customers embark upon. Your goal is to guide them smoothly from being curious wanderers to loyal patrons.

First up, lead generation – attracting those potential customers to your doorstep. To reduce CAC, focus on quality over quantity. It’s like fishing – you want to catch the big, juicy fish, not waste time with tiny minnows.

Once they’re in the funnel, don’t let them slip away! Plug those leaky holes where leads drop off. Nurture and engage them at every stage, like a friendly tour guide showing them the wonders of your products or services.

Utilise Automation Solutions

Now, imagine having a trusty assistant to handle the mundane tasks – that’s where automation comes in! With tech wonders at your fingertips, you can automate repetitive tasks like sending emails, updating data, and scoring leads.

Automation lets you focus on the human touch, building real connections with your leads and customers. It’s like having a team of tireless helpers while you steer the ship towards success.

Improve Your Lead Quality & Targeting

Time to become a customer magnet! But not just any customers – your ideal customers. To reel them in, you need to understand them like the back of your hand. Dive into market research to uncover their needs, desires, and pain points.

With this treasure trove of insights, you can craft tailored messages that speak directly to their hearts. When your targeting is spot-on, you’ll attract customers who are a perfect fit for your business, lowering your CAC like a pro.

Invest in Retention Efforts

Don’t overlook the riches that lie within your existing customer base. Happy customers are like precious gems – they shine and attract others to your business.

Invest in keeping your customers happy and coming back for more booty! Reward loyalty, offer exclusive deals, and show them you care. When they spread the word about your awesomeness, it’s like free marketing gold!

By optimising the sales funnel, embracing automation, targeting your ideal customers, and nurturing loyalty, you’ll become a customer acquisition wizard! These strategies empower you to work smarter, not harder, and sail towards cost-effective customer acquisition like a seasoned captain on a grand adventure!

Optimise the Sales Funnel Model

To optimise the sales funnel model and move away from outdated attribution practices, companies need to shift their focus from department-centric measurement to buyer-centric measurement. Here’s how to make it happen:

- Identify Pipeline Sources: Look closely at the various triggers that bring buyers into your sales pipeline. These triggers are called “pipeline sources.” Instead of just measuring the number of leads, focus on understanding how and why the buyer entered the pipeline. These pipeline sources are indicative of buyer intent, and they can better predict sales efficiency metrics like win rate, sales cycle length, and pipeline velocity.

- Separate Attribution Model: Develop a separate attribution model that characterises the programs responsible for creating demand. This could be based on self-reported attribution data, where buyers indicate which marketing efforts influenced their decision-making process.

- Data-Driven Strategy: Use the data collected from pipeline sources and attribution models to optimize your entire revenue strategy. Instead of merely determining credit for teams and departments, this data-driven approach will guide strategic decisions and resource allocation more effectively.

Implementing this framework will bring several advantages:

- Improved GTM Alignment: The approach fosters better alignment between all GTM teams (Sales, Marketing, SDRs, Customer Success). Instead of fighting over credit, teams will collaborate to achieve common goals.

- Cooperation Over Competition: With all teams working together towards the same objective, cooperation replaces competition, creating a healthier and more productive work environment.

- Informed Decision-Making: Revenue leaders and strategists gain an entirely new view of performance, leading to better decisions and improvements in overall strategy.

- Accurate Forecasting: Revenue planning and forecasting accuracy will improve significantly, thanks to a more data-driven and comprehensive approach.

- Focused Strategy: With clear insights into what triggers successful pipeline entries, teams will know where to focus their efforts and which activities to prioritise.

As the business landscape evolves, it’s crucial to adopt a holistic, objective, and buyer-centric view of your GTM performance. By understanding buyer intent, optimising your revenue strategy, and fostering collaboration among teams, your company can sail towards greater success in the dynamic marketplace of 2023.

Types of Costs to Include in a Customer Acquisition Cost Formula

Ad Spend

Ad spend includes the expenses incurred in advertising and marketing efforts to attract potential customers. It covers the cost of online ads, social media campaigns, and other promotional activities.

Employee Salaries

Employee salaries refer to the wages paid to the team members involved in acquiring new customers. It includes the compensation for marketing, sales, and other relevant personnel.

Creative Costs

Creative costs encompass the expenses associated with designing marketing materials, creating content, and developing appealing visuals to attract customers.

Technical Costs

Technical costs include expenses related to website development, software tools, and other technical resources used in customer acquisition efforts.

To gain deeper insights into Churn360, we recommend setting up a demo with one of our experts for a detailed walkthrough

Book a demo

Publishing Costs

Publishing costs involve the expenditures associated with distributing content, such as printing flyers, running sponsored posts, or sending out newsletters.

Production Costs

Production costs cover the expenses of creating products or services offered by the business.

Inventory Upkeep

Inventory upkeep includes the costs of managing and maintaining the inventory of products or services, ensuring they are readily available for customers.

By including these various costs in the CAC formula, businesses can accurately assess the investment required to acquire each customer. This understanding enables informed decision-making and optimization of customer acquisition strategies, leading to improved overall performance and profitability.

5 ways to reduce customer acquisition cost

1. Optimise your sales and marketing funnel.

This means making sure that your marketing and sales efforts are aligned and that you are targeting the right people with the right message. You can also use automation to streamline your sales process and reduce the amount of time your sales team spends on administrative tasks.

2. Optimise your pricing strategy.

Make sure that your pricing is competitive and that you are not overpaying for your marketing and sales efforts. You can also use pricing to segment your customers and offer discounts to high-value customers.

3. Strengthen the effectiveness of sales and marketing spend.

Make sure that you are tracking the results of your marketing and sales campaigns and that you are making adjustments as needed. You can also use tools like A/B testing to test different marketing and sales strategies.

4. Quickly engage new customers and prospects.

Make sure that you are quickly engaging new customers and prospects with personalised messages and offers. This will help you to increase the chances of converting them into paying customers.

5. Invest in customer retention.

The best way to reduce CAC is to keep your existing customers happy and engaged. This will reduce the amount of money you need to spend on acquiring new customers.

By following these tips,You can reduce your CAC and improve your bottom line.