What is weighted ACV?

The Weighted ACV (WACV), proportionate to the contract’s value, determines the average contract dollar value. In essence, while determining a corporation’s overall average contract value, higher-value contracts are given greater weight. By precisely determining an ACV that is not affected by contracts with a low dollar value, this method is beneficial to businesses with highly variable client concentrations.

A customer’s weighted ACV (WACV) is the percentage of revenue they provide to your total revenue; for example, a client contributing 5% of your revenue would be given a weight of 5%, whereas a customer contributing 5% of your revenue would be given a weight of 0.5%.

Revenue is frequently distributed among several contract sizes. You can identify where your revenue is focused if a small number of clients account for a sizable portion of your entire business. 20% of your customers provide 70% of your income.

The weighted ACV (WACV) is a crucial indicator for your investors to discuss. If you provide your normal ACV measure for early-stage enterprises, your ACV may be affected due to your lower client base or free usage.

To illustrate the current value of your weight average contract size, represent your WACV as a summary chart. To determine how this figure has changed, you can compare your WACV with a previous period, such as a year-over-year comparison. Although it’s crucial to bear in mind other aspects like client concentration, customer base size, high-risk customer profile, and attrition, you generally want your WACV to improve.

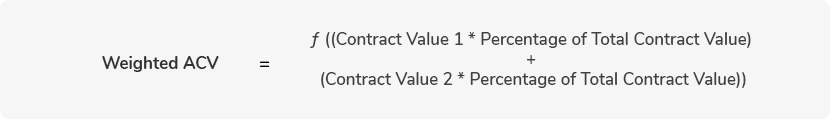

Weighted ACV formula

You may better understand your clients by using a customer-weighed measure. ACV is a customer-weighted measure, meaning each client is given equal weight. As a result, if there are 1000 clients, each client’s contract value is “weighted” or multiplied by 1/1000 before being added. Each client is given an identical weight. Therefore, the final statistic provides information about the typical customer.

How to measure weighted ACV

Consider that a SaaS business have three clients. Client 1’s contract is worth $40,000, whereas the contracts with the other two are worth $5000. The sum of these figures (40,000 + 5,000 + 5,000) equals a contract value of $50,000.

The following formula is used to determine your weighted ACV: ($40,000 * ($40,000 / $50,000)) + ($5,000 * ($5,000 / $50,000)) + ($5,000 * ($5,000 / $50,000)).

You now have a WACV of $33,000. This is far more complex than the $17,000 you would receive using the standard ACV measure.

SaaS platforms with clients of various sizes, as determined by the Customer Concentration statistic, benefit greatly from WACV. Customers of all sizes would receive equal consideration under ACV, while WACV prioritizes the contracts with the largest income.

Instead of diluting your ACV with a large number of low-deal value clients, the main advantage of calculating your ACV in this approach is that you obtain an accurate dollar value for your customer profile. Companies frequently filter out contracts below a predetermined level, which they do in any case. The arbitrary criterion is replaced with actual weighting under WACV depending on how much a client contributes to your overall revenue.

If you want to comprehend the company’s revenue as effectively as possible, weighted ACV (WACV) advises you where to search. For instance, a WACV of $25,000 indicates that a typical $25,000 client generates $1 in revenue.

As a result, the business’s revenue dynamics—including revenue retention, churn, and other factors—will likely follow the patterns that would anticipate for those types of clients. If the firm in issue has a significant number of customers making small or no purchases, polluting the equal-weighted ACV (WACV) calculation, revenue-weighting is very useful.

The main portion of the revenue base’s monetization fluctuates with variations in WACV. Similar to net dollar retention, customers with the greatest financial effect will also have the greatest impact on WACV.

Weighted ACV example

By dividing your entire contract value by WACV, you may also utilize WACV to determine which clients are extremely significant customers.

Consider the scenario when your WACV is $250,000, and your total contract value is $500,000.

If you split the overall contract value by WACV, you get two, which means that two to three clients account for the bulk of your revenue.

You may use this measure to effectively determine where most of your revenue comes from after you grow this up to a sizable client base. Then you may use this knowledge to pursue clients with similar profiles and develop enduring connections with them.

Back to churn metrics

Back to churn metrics