What is recovering customer acquisition Cost?

Recovering customer acquisition cost, sometimes referred to as the CAC payback period or months to recover CAC, is a measure that illustrates the length of time needed to recoup expenditures in customer acquisition. It shows when the company’s investment in client acquisition will become profitable. Usually, the length of recovery is expressed in months.

SaaS providers and other subscription-based businesses frequently use the time to Recovering Customer Acquisition Costs. Businesses that operate on a subscription basis must invest money to bring in new clients. The consumers then pay them over several periods.

One of the strongest signs of such organizations’ success over time is a decline in Customer Acquisition Costs Recovering Time. Generally, a business takes a year to recoup its client acquisition expenditures. Many successful SaaS businesses may recoup CAC in up to seven months. However, sometimes the recovery time often exceeds 12 months for many early-stage businesses. For such businesses, one of the greatest measures of growth is a shorter payback period over time.

A prolonged CAC payback time often indicates that a business needs to increase acquisition effectiveness. Client monetization and acquisition costs are often the two main areas that need improvement.

Customer monetization issues are a sign that the business is having trouble turning its acquisition techniques into real earnings. Companies that struggle with consumer monetization often attempt to alter the price structures available to clients.

How to calculate the time to recover customer acquisition cost

The Recovering Customer Acquisition Cost provides some important insight into the business’s capital and acquisition efficiency. In other words, the indicator shows how well a business uses its marketing budget to bring in new clients and how well it can maintain its acquisition techniques over time.

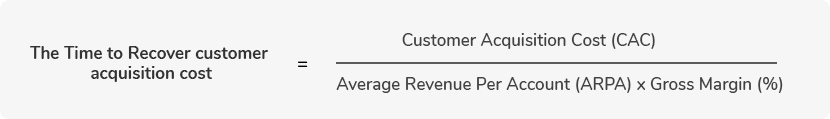

By dividing the customer acquisition cost (CAC) by the average revenue per account and the company’s gross margin, one may determine the Recovering time of CAC.

Keep in mind that the measure is derived from gross margin. This is justified by the fact that a business has to make some operational profits to recoup its cost of client acquisition.

Let’s look at the formula to calculate the time to recover customer acquisition costs.

The formula to calculate the time recovering customer acquisition cost

One can calculate the Time Recovering Customer Acquisition Cost with the formula below:

The Time to Recover customer acquisition cost = Customer Acquisition Cost (CAC) / Average Revenue Per Account (ARPA) x Gross Margin (%)

Or

Customer Lifetime Value = Average monthly revenue per Account x Gross Margin x Customer lifetime.

Let’s understand the calculations with an example.

Example of recovering customer acquisition cost

Say a SaaS business named XYZ has 50 new customers with a gross margin of 60% and a customer lifetime of 18 months. The business earns average monthly revenue per customer of $2,000.

To onboard those customers, XYZ incurs the following costs:

A team of three marketing employees with an average salary per quarter of $30,000 = 3 x $30,000 = $90,000

A team of 5 sales employees with an average salary per quarter of $37,000 = 5 x $37,000 = $185,000

External agency costs worth $60,000

Additional spends on the program = $110,000

Therefore, total customer acquisition cost (CAC) for 50 employees = $445,000

Hence, CAC for each customer = $445,000 / 50 = $8,900

Let’s use the first formula.

The Time to Recover customer acquisition cost = Customer Acquisition Cost (CAC) / Average Revenue Per Account (ARPA) x Gross Margin (%)

Customer Acquisition Cost (CAC) = $8,900

Average Revenue Per Account (ARPA) = Average monthly revenue per customer = $2,000

Gross Margin = 60%

Therefore, the Time to Recover customer acquisition cost = $8,900 / [$2,000 x 60/100] = $8,900/ [2,000 x 0.6]

= 7.4 months

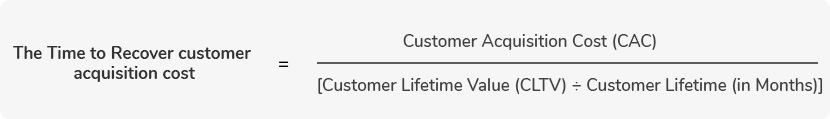

If we use the second formula:

The Time to Recover customer acquisition cost = CAC/ [Customer Lifetime Value (CLTV) ÷ Customer Lifetime (Measured in Months)]

Customer Lifetime Value = Average monthly revenue per Account x Gross Margin x customer lifetime

= $2,000 x 60/100 x 18 = $21,600

Therefore, Time to Recover customer acquisition cost = $ 8,900 / [21,600 / 18]

= 7.4 months

Back to churn metrics

Back to churn metrics