What is net MRR churn rate

After considering any additional income from current clients, such as expansions or upgrades, Net Monthly Recurring Revenue (MRR) Churn Rate is the measurement of revenue lost over a month owing to user dropouts and downgrades. It displays revenue churn less growth. Contrarily, the Gross MRR Churn Rate calculates the company’s overall loss, excluding growth.

When upgrades outweigh downgrades and dropouts, the Net MRR Churn Rate is negative, which is a very good sign for the business. While it may also be represented as an annual rate using the Net Annual Recurring Revenue (ARR) Churn Rate, the Net MRR churn rate is commonly reported as a monthly rate.

Since one of the biggest barriers to progress is the Net MRR Churn Rate, monitoring it is crucial for assessing the sustainability of a SaaS company. Net churn emphasizes viability by taking into account growth MRR and answers the question: can the company continue to expand with this turnover rate? To maximize the effectiveness of the new MRR, businesses should strive for a negative or even zero churn rate.

Churn is a result of choosing the proper clients to pursue and raising the value of the business offering. Since it incorporates disgruntled customers who cancel or drop out and satisfied clients, Net MRR Churn Rate may conceal vital information, such as clients who choose to upgrade their accounts, if monitored solely. It’s good to monitor Expansion MRR and Gross MRR Churn Rate separately for such data.

How to measure net MRR churn rate

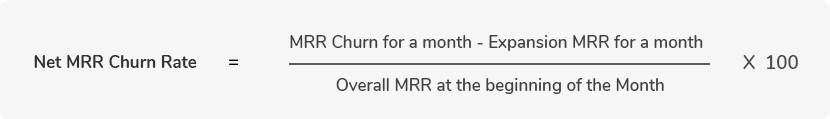

Expansion MRR is subtracted from churn MRR before calculating the net MRR churn rate. Churn covers both client downgrades or “contractions” and user dropouts or cancellations. Divide the outcome by the overall MRR at the beginning of each month. To convert it into a percentage, multiply the result by a hundred.

There is a chance that the net MRR Churn Rate may be negative when the growth MRR for the period is higher than the churn MRR, including dropouts and downgrades.

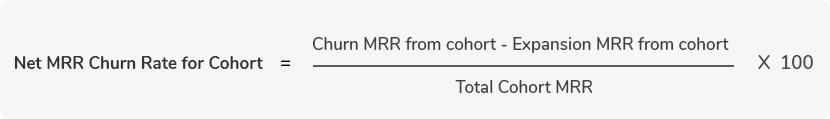

Instead of a monthly net MRR Churn Rate, one can use cohort calculations to get the cohort Net MRR Churn Rate. Simply alter the values to match the cohort length instead of one-month figures to use the formula given.

Net MRR churn rate formula

Here’s the formula to calculate the monthly Net MRR Churn rate:

To calculate Net MRR Churn Rate on a cohort basis, the formula remains the same with minor adjustments. Just change the monthly values to those that reflect the cohort period. Here’s the formula:

Let’s understand more with a calculation example below.

SaaS net MRR churn rate example

Say a SaaS company named XYZ records the total MRR for the month as $100,000. The churn experienced from the discontinuation of services and downgrades is $4,000. It also had some customers who chose to upgrade, resulting in an expansion MRR of $1,600. Then, the net MRR Churn Rate will be:

Net MRR Churn Rate (in percentage) = (MRR Churn for a month – Expansion MRR for a month) / Overall MRR at the beginning of the Month X 100

Here, MRR Churn for a month = $4,000

Expansion MRR = $1,600

Overall MRR at the beginning of the month = $100,000

Therefore, Net MRR Churn Rate = $(4,000 – 1,600) / $100,000 x 100 = 2.4%

Since the net MRR Churn Rate is positive, it indicates the number of downgrades and dropouts or cancellations outweigh the addons or upgrades from the clients. XYZ needs to make more efforts in reducing turnover to have a sustainable expansion over time.

However, say the churn of XYZ was $3,000 instead of $4,000, and the expansion was $4,000 instead of $1,600. The Net MRR Churn rate would be:

= $(3,000 – 4,000) / $100,000 x 100 = -1%

In this case, the net MRR Churn Rate speaks positively about the company’s viability in the future.

The business can also calculate Net Churn Rate on Cohort Basis by replacing monthly values with the values for a cohort.

Standards for churn rate vary widely based on a business’s stage and size. Standards for customer vs. revenue churn and gross vs. net churn are ambiguous. Although the range for each firm category might still be useful, many of the standards offered concentrate on customer turnover rather than revenue churn.

Back to churn metrics

Back to churn metrics