What is gross revenue retention?

Gross revenue retention (GRR) Rate is the rate of repeating revenue from current customers that are kept over a specific time period, taking into account downgrades and cancellations. Gross Renewal Rate (GRR) is another name for this concept.

In contrast to net revenue retention (NRR), this excludes growth and just centers on your current recurring earnings, churns, or downgrades. The highest value for GRR is only 100%, unlike Net Revenue Retention (NRR), which may go over 100% owing to growth.

Always remember that client retention differs from gross revenue retention. Assume that after a month, some of your customers decide to downgrade to less expensive plans and spend less than they did the month before. Your client retention measure won’t change, but your gross revenue retention will be reduced as a result.

A high gross retention rate is a sign that the product or service offers solid value to its clients. It’s also known as a “sticky” product in this situation. However, a low GRR suggests that a company is not sustainable over the same period. Certain areas of the business need attention, as seen by the greater rates of churns and downgrades.

Making the most of your gross retention is a crucial aspect of profitability because it may cost 5 to 25 times more to get a new client than it does to keep an existing one. By maintaining your current client’s revenue, one can lower the customer acquisition costs (CAC) and boost profitability.

How to measure gross revenue retention (GRR)

The ideal Gross Retention for entrepreneurs is as high as feasible, but even that goal is almost impossible for a few years in operation. While the maximum Gross Retention is 100%, some churn should be expected due to unavoidable reasons. However, this proportion could be low.

Companies should keep a measure of the Gross Revenue Retention rate and examine the causes of all churns and categorize them into preventable reasons and reasons that may be averted if future measures were made. You need the following statistics to compute the gross revenue retention rate (GRR):

- Income at the start of the time period.

- The sum lost as a result of churn.

- The sum lost as a result of downgrades.

Once you have this information, you can simply calculate the rate by dividing the income at the start of the period by the income without all the sums lost. Since it’s represented in percentages, multiply the number you get by a hundred.

GRR may be evaluated for different periods of time. It can be just for a day, maybe a week, a month or two, a year, or more. Ensure that the timeframes you are utilizing for calculation are consistent.

Gross revenue retention (GRR) formula

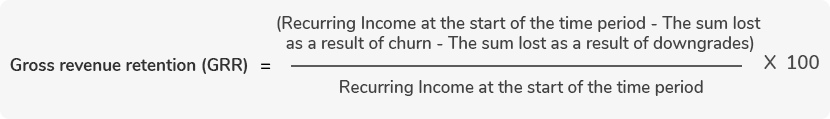

Here’s the formula that businesses can use to calculate Gross Revenue Retention for a particular time:

Let’s understand the calculation with an example.

SaaS gross revenue retention (GRR) example

Say a company named XYZ has 300 customers paying $1000 every month. Then the recurring income at the start of the month is $300,000.

If in the month of January, three customers canceled and two downgraded their plan to $500, then:

The sum lost due to churn = $3,000

The sum lost due to downgrades = $ 1,000

Therefore, the Gross revenue retention (GRR) rate will be:

Gross revenue retention (GRR) = [(Recurring Income at the start of the time period – The sum lost as a result of churn – The sum lost as a result of downgrades) / Recurring Income at the start of the time period] x 100

= (300,000 – 3000 – 1000) / 300,000 = 98.66 %

Hence, the gross retention rate for XYZ is 98.66%

Any business model may use the gross revenue retention formula, although SaaS providers should place greater emphasis on this. Gross revenue retention is an important factor for a developing SaaS business that wants to draw in additional investors. As a critical indicator of your company’s long-term health, it is one thing that investors pay close attention to.

Back to churn metrics

Back to churn metrics