What is gross margin

When total sales are subtracted from the cost of goods sold (COGS), the resulting figure is the Gross Margin for that time frame. It reveals the amount of money available after covering direct costs that the business may use to cover fixed expenditures and other non-operating expenses. A business with a high gross margin can keep more earnings and utilize that money to cover expenses or make debt payments.

How to measure gross margin

A company’s gross margin is determined by dividing its gross profit by its income for the same timeframe. Both figures appear on the income statement prepared in accordance with GAAP. The net revenue and COGS numbers must be obtained from the income statement to determine the gross margin. Next, determine gross profit by deducting COGS from the total revenue. We can then calculate the gross profit margin by dividing each business’s gross profit by its revenue for the relevant period.

Gross margin formula

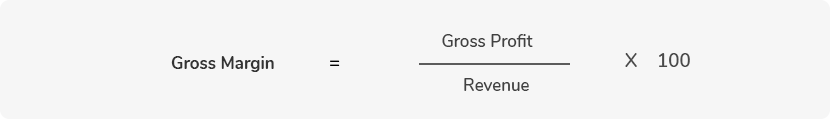

We can use the following equation to get the gross profit margin:

Here, Gross Profit is leftover income after deducting direct expenses or cost of goods sold.

Cost of Goods Sold (COGS) is a business’s direct expenses that are closely related to the creation and supply of certain items or services.

SaaS gross margin example

Consider a SaaS firm named XYZ that earned $20 million in income based on its income statement for 2021. They recorded $5 million in COGS, which means the gross profit is $15 million (total revenue – COGS). So now:

Revenue = $20 million,

Cost of Goods Sold (COGS) = $5 million,

Gross profit = $15 million.

Since Gross Margin in Percentage = Gross Profit / Revenue x 100, it will be:

15 million / 20 million x 100 = 75%

From this, we may infer from the 75% gross margin that the business made $0.75 in gross profit for every $1.00 in sales.

The industry in which a firm works significantly impacts whether or not to interpret its gross margin is positive or negative. For instance, clothes merchants have traditionally shown lower gross margins and rely on quantity to be viable. On the other hand, software firms have long been renowned for having higher gross margins. Due to their low COGS, service-based sectors also have larger gross margins.

For comparisons to be meaningful, the businesses must be involved within the same or a closely related industry, and historical data going back many years must be accessible. Larger gross margins are often seen in a positive light since they raise the possibility of greater operating and net profit margins.

Let’s look at another example of a SaaS company named ABC. In 2021, ABC made a total revenue of half the amount of XYZ. Therefore, their total earnings were $10 million. Their direct expenses or COGS were $2 million, which means their gross profit amounts to $8 million. So now:

Revenue = $10 million,

Cost of Goods Sold (COGS) = $2 million,

Gross profit = $8 million

Since Gross Margin in Percentage = Gross Profit / Revenue x 100, it will be:

8 million / 10 million x 100 = 80%

This means that even though ABC earned only half the revenue as XYZ, its gross margin percentage is higher due to lower COGS. Therefore, ABC earned $0.05 more than XYZ for every dollar in sales.

Let’s take one last example of the KLM clothing company. In 2021, KLM made a whopping sales revenue of $50 million. However, when measured with the cost of goods sold, markups can seem to be large.

When these expenses are considered, the profit the clothing firm makes is substantially smaller, and clothes merchants need to sell many items to continue in business.

So let’s say KLM’s COGS were $25 million. This means their gross profit is $25 million. So now:

Revenue = $50 million,

Cost of Goods Sold (COGS) = $25 million,

Gross profit = $25 million

Since Gross Margin in Percentage = Gross Profit / Revenue x 100, it will be:

25 million / 50 million x 100 = 50%

It may seem that KLM’s gross margin is significantly lower than ABC’s and XYZ’s. However, it is important to remember that KLM is not in the same industry as XYZ and ABC. Hence, we should make no judgment based on that comparison. To properly understand KLM’s profitability, we should compare its gross margin with other clothing companies.

Back to churn metrics

Back to churn metrics