If you want to improve your customer retention rates and boost your product’s growth, it’s important to track the right customer retention metrics.

These metrics will provide you with valuable insights into your customers’ needs, how well you retain your customers, and can assist you in identifying areas for product improvement.

In this article, we’ll be discussing customer retention metrics and which ones you should be tracking. Let’s get started.

What is customer retention?

Customer retention refers to a company’s ability to retain its existing customers and turn new customers into repeat buyers. It’s about building strong, lasting relationships with customers to make them feel valued and ensure they stick with your product.

What are retention KPIs in SaaS?

Customer retention metrics measure how well your company retains its customers and their satisfaction throughout their user journey.

Metrics like the customer satisfaction score (CSAT) and net promoter score measure the overall satisfaction and value that customers experience from the product. Analyzing these metrics can help companies identify areas for improvement as well as make adjustments to better retain customers.

Why should you track customer retention metrics?

There are many reasons why you should track customer retention metrics:

- Reveal opportunities to improve your product and customer experience.

- helps you focus on the right metrics and keep your team accountable for making sure your business is running as efficiently as possible.

- understanding which customers are most likely to churn is an important part of improving customer retention rate.

5 Key Customer Retention Metrics You Should be Tracking

There are 5 customer retention metrics you should be tracking. These metrics will help you focus on how well your company retains customers and also show you areas for improvement in your customer journey.

Retention metric #1: Customer retention rate (CRR)

Customer retention rate is the percentage of customers who remain with your company over time. You can use it to determine how satisfied customers are with the product and their overall experience.

Having a CRR indicates that customers are satisfied with your product and feel confident about it. It also saves you from increased acquisition costs since existing users love and trust your brand.

Meanwhile, a low CRR signals a need for product improvement. Collecting customer data and feedback can reveal the cause of this and help you fix it.

How to calculate customer retention rate

To calculate the customer retention rate, you need to first pick a timeframe. Then, choose:

- The total number of customers at the beginning of the time frame (S)

- The number of customers at the end of the time frame(E)

- The number of new customers added within that time frame (N)

CRR = ((total number of end customers (E)- New customers added (N))/ Number of beginning customers (S) ) X 100

For example, you had 6,000 subscribers at the start of 2020 and gained 3000 new subscribers. By the end of 2020, if this rate had increased to 10,000, then your CRR would be:

CRR = 10,000 (E)-6000 (N) X 100 = 50% retention rate

8,000(S)

What is a good customer retention rate?

Depending on the type of industry, CRR percentages vary. For example, in SaaS, a CRR of 85-95% is considered good, with room for 5% churn. In other industries, a 50-70% range is more acceptable.

How to improve customer retention rate

Creating a strong onboarding experience is the first step to improving your customer retention rate. This is because users who feel welcome and comfortable are more likely to stick around.

With Customer retention software, you can easily monitor the in-app behavior of users to identify engaged and disengaged customers.

Combine this with a personalized user experience, and you’ll be well on your way to gaining customer loyalty. You can also collect customer feedback with NPS surveys to see how customers feel about your product.

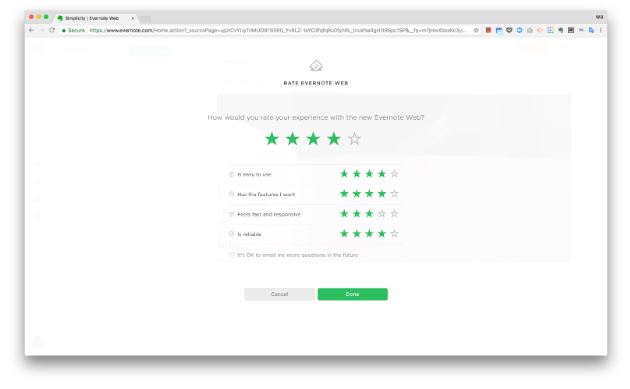

Here’s an example from Evernote:

Analyze this data to reveal areas of friction and uncover room for improvement in your product.

Retention metric #2: Churn rate

Customer churn rate is the percentage of customers who stop using your product at a time period. Several factors could lead to a high churn rate, including changes in the market, poor product/customer service, inadequate product offerings, etc.

A high churn rate represents a loss in revenue and indicates a problem with a company’s product or user experience. This would also lead to an increased acquisition cost as new customers would have to be brought in every time.

How to calculate customer churn rate

First, pick a timeframe (e.g., a month), then subtract the number of customers at the beginning and end of it to get the number of customers lost. Divide this by the total number of customers at the beginning and multiply by 100.

Churn rate = (number of customers lost /Total number of beginning customers )X 100

For example, if a SaaS company had 100 customers at the beginning of a month and 90 customers at the end of the month, its customer churn rate would be 10%.

Churn rate = 90 X 100 = 10%

100

What is a good customer churn rate?

Unlike retention rate, customer churn rate should be kept at the minimum. In SaaS, this should be between 3-8%, anything above that is bad for the product.

How to reduce customer churn rate

To reduce the churn rate, you need to first understand why it’s happening. Collect this data at various touchpoints of the user journey to understand how people act at various parts of the user journey.

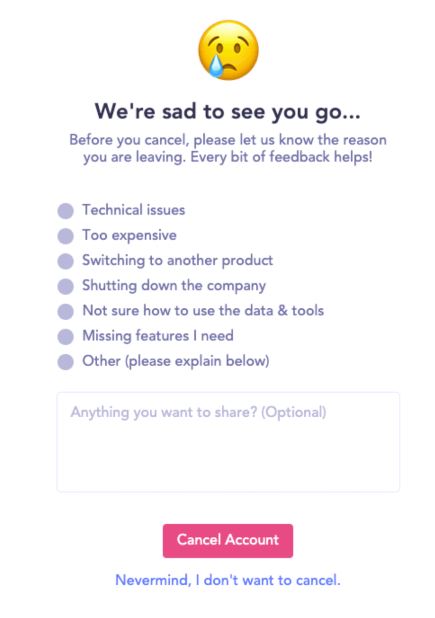

Segment these users and proactively reach out to them, or build a churn survey to find out why they’re leaving.

Gather and act on the customer feedback contextually. It will help you identify friction points in your user journey and reveal areas for product improvement.

Source: Baremetrics

Retention metric #3: Monthly recurring revenue (MRR)

Monthly recurring revenue (MRR) is a key metric for subscription-based businesses. It measures the amount of revenue that a company can expect to receive on a recurring basis each month from its customer subscriptions.

MRR is important because it allows businesses to forecast future revenue, plan for growth, and make informed decisions about product development. It’s also a key metric for investors, as it measures the stability and predictability of a company’s revenue stream.

How to calculate monthly recurring revenue

Calculating monthly recurring revenue is straightforward. First, take the total number of paying customers and multiply it by the average monthly subscription fee. This will give you the total monthly recurring revenue from customer subscriptions.

MRR = Number of paying customers x average monthly subscription fee

For instance, if you have 30 subscribers paying $200/month, your MRR will be:

MRR = 30 x $200 = $6,000

How to improve monthly recurring revenue

You can improve monthly recurring revenue by focusing on customer retention and satisfaction.

Creating unique features that solve users’ needs is a great way to make them stay. Combining this with excellent customer support can help retain customers and encourage them to upgrade to higher-priced subscription plans.

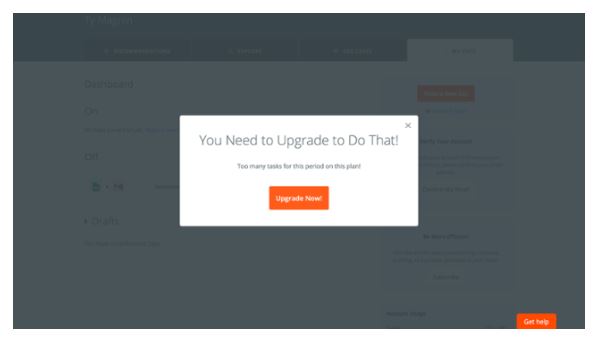

You can also prompt existing customers to upgrade their plan with a modal. This can be in the form of upsells, cross-sells, or add-ons to existing subscriptions.

Take, for example, Zapier triggers an upgrade prompt depending on the user’s actions or when they reach a stage in their user journey.

Also, focus on acquiring and retaining new customers. This can be done through effective marketing and personalized onboarding to boost product adoption.

Retention metric #4: Customer Lifetime Value (CLV)

Customer lifetime value refers to the average amount of money that a customer will spend with your business over their customer lifecycle. This metric measures a customer’s profitability and predicts a business’s potential for long-term growth.

Measuring CLV will also reveal insights into what’s working with customers, help you prioritize retention efforts, and identify opportunities for increasing customer value.

How to calculate customer lifetime value

Customer lifetime value is calculated by multiplying the average revenue per user (ARPU), the average customer lifespan, and the average purchase frequency.

CLV= Average customer lifespan x Customer Value

Here’s how to calculate CLV in 3 steps:

-

- First, determine the average purchase value (APV) by dividing the total revenue by the number of users in a specified period (usually a year).

Average purchase value = Total revenue / Total number of purchases

For example, if your business has 1,000 users and generates $100,000 in revenue per year, the APV is $100.

-

- Determine the average purchase frequency rate (APFR) by dividing the total number of purchases in a specific period by the number of customers.

Average purchase frequency rate = Number of purchases / Number of customers

If your business makes 4000 sales in a year with 1,000 users, the average purchase frequency rate is 4.

-

- Multiply the APV by the average purchase frequency rate to determine the customer value.

Customer Value (CV) = Average purchase value x Average purchase frequency rate

The average of each customer’s value would be: CV = $100 x 4 = $400.

Schedule a demo with one of our experts to take a deeper dive into Churn360

Book a demo

-

- Calculate the Average Customer lifespan (ACL). To do this, divide the sum of customer lifespans by the number of customers.

Average customer lifespan = Sum of customer lifespans / Number of customers

However, if you don’t have that much data, then you can calculate it as follows:

Lifespan = 1/Churn rate

So if you have a churn rate of 24%, that means your Lifespan would be 1/0.24= 24 months

- Now that we have all necessary components, we can calculate our customer lifetime value.

CLV= Average customer lifespan x Customer Value

Customer Lifetime Value = $400 x 24 = $9,600 per customer.

How to increase customer lifetime value

You can improve your customer lifetime value by optimizing your onboarding process. Customers who get value from your business tend to stick around longer and build long-lasting relationships.

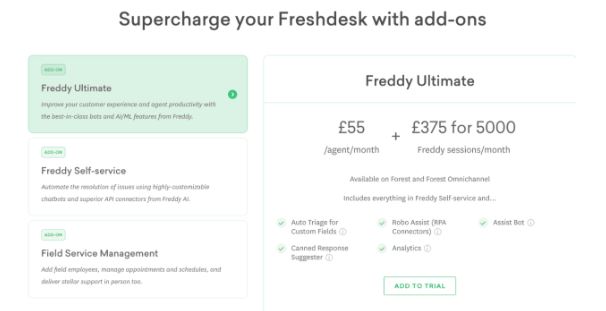

You can also look for ways to encourage your customers to spend more on your business. Offer cross-sell and upsell opportunities contextually that complement what users are doing and help you generate more revenue from each customer.

Here’s an example from Freshdesk.

Also, pay attention to improving your customer experience. Make it easy for customers to use your product; provide a self-help knowledge base; and, when customers need help, provide excellent customer support.

Read more: Tips on How to Improve Customer Lifetime Value

Retention metric #5: Customer Satisfaction Score (CSAT)

Customer satisfaction score measures how happy or satisfied customers are with your product, from its features, customer support, or the customer journey. It not only gauges the effectiveness of your product but also assesses its quality.

Examples of customer satisfaction surveys include: net promoter score, customer satisfaction score (CSAT), customer effort score (CES), and product-market fit (PMF) survey.

How to calculate customer satisfaction score

To calculate the customer satisfaction score, you need to create a customer satisfaction survey. This could be through surveys, focus groups, or customer feedback forums.

You can trigger in-app microsurveys to ask users questions about their experience, satisfaction, effort, e.t.c. Keep your questions relevant, short, and straight-forward.

Here’s an example from Hotjar.

Afterwards, divide the number of “happy” customers by the total number of customers who took the survey to get your CSAT.

How to increase customer satisfaction

To improve customer satisfaction, focus on optimizing your overall customer experience. You can do so by:

- personalizing your product experience so that its relevant to the user

- improving your product’s features to meet user expectations

- collect and address negative customer feedback when they arise

Conclusion

Creating loyal, happy customers is the key to building a sustainable business. Tracking customer retention metrics drives you towards that goal and helps you focus on delivering a positive experience.